You will find the appropriate details for the TV License Tax South Africa: What is This and When Will it be implemented from here. The citizens can opt for the TV License Tax South Africa after checking their eligibility. Every citizen has to take the license and pay the amount to get the whole set. The broadcast will be made to the public along with the recurring advertisements.

TV License Tax South Africa

The best sources of Entertainment the Television and Radio. These help to provide pertinent information for the trends in the country and the world. People like to watch broadcasting channels, but before that, they have to pay the TV License Tax South Africa.

The authorities will take the payment from you to promote the entertainment needs. The individuals must get the license else they will be charged with a penalty when caught by the TV license inspector.

|

Important Links |

What is This?

Funding for the public broadcasting centre is essential. The citizens will have to pay a certain amount of fees to watch their favourite channels or shows. There will be fewer ads that the viewers have to watch than continue watching the television show. The payment status and the renewal status can be confirmed from the relevant portal.

The applicants must ensure that the documents they are uploading are suitable. Otherwise, the officials might cancel the application. Once the application is verified, the people can begin to watch the shows that they want.

TV License Tax Eligibility Criteria

The nearest retailer or the post office issues the license. The process is smooth for the individuals. They can take the assistance prior to the license form submission.

The eligibility for the license is that a particular person must have one or more television/radio in their personal or commercial spaces. The license is only for the citizens of the country as they will have to submit residency proof. The first time applicants have to pay the fees during the form submission.

When Will it be implemented?

Now that you have checked the eligibility, it is time for you to complete the application submission. The citizens must know the steps with which they can submit the application.

- First of all, visit the website of the South African Broadcasting Corporation, and go to the post office or the retailer.

- Take the license application and the required details. The columns have to be filled appropriately.

- Attach the documents such as residency proof, television set(s) details & documents, income proof, identity proof and more.

- Pay the fees, and do not forget to check the critical details of future payments.

- The television license will be issued once the verification is completed by the concerned authorities.

The license holders must note that they have to renew the license once in every year to continue taking the broadcast services. R265 is the initial fee and for the renewal, it will be R28. A 10% penalty will be imposed on the people who will not pay the fees or renew their TV license.

|

Important Links |

The license shall be implemented according to the norms of the South African Broadcasting Corporation. The applicants can browse the site to get the latest information.

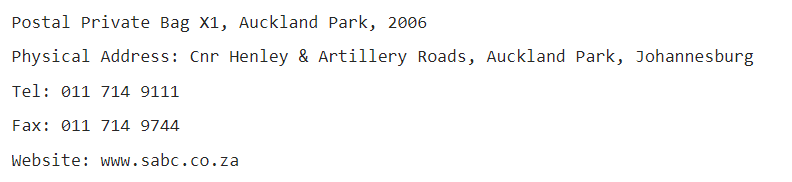

The image above reflects the details of the contact details of SABC. The individuals must share their queries in a detailed manner to get the proper assistance.

TV License Tax South Africa Check

The license holders have to navigate to sabc.co.za and log in with the authentic credentials. The relevant link would be available for checking the details of the license. The new bill by SABC ensures that the TV License will be coming soon for the beneficiaries. The evasion rate is 82%, as per the recent statistics. This provides an estimation for the several applicants and users of the TV License.

In case the individual would want to cancel the license, then they have clearly stated the reasons. Either they have sold the TV, rented it, or gifted it to someone. There could be issues with the broadcaster or the television require a repair.

The request has to be sent to the concerned authorities with the appropriate reason, the details of the broadcaster, issues with the contract and more. The documents must include the license, broadcaster details, etc, as mentioned by SABC.