Check out the details about ScotiaBank GIC Rates: What are the Prime rate and Mortgage Rates of ScotiaBank? from this article. Various information on ScotiaBank GIC Rates: What are the Prime rate and Mortgage Rates of ScotiaBank? and other substantial details are included in this article.

ScotiaBank GIC

Many banks offer GIC Investments in Canada. These banks offer these investments at different GIC Rates. One of the banks in Canada that offers GIC Investment is ScotiaBank. GIC investments offer stable and guaranteed returns.

ScotiaBank offers different types of GIC Investments – Cashable GICs, Non-Redeemable GICs, Market Linked GICs, and Personal Redeemable GICs. Each type has a different term period and different GIC Rates.

|

Important Links |

ScotiaBank GIC Rate

| Name | ScotiaBank |

| Country | Canada |

| Personal Redeemable GICs (annual rate) | 4.50% (term period – 24 months) |

| Non-redeemable GICs (annual rate) | 5.75% (term period – 2 years) |

| Non-redeemable GICs (annual rate) | 5.45% (term period – 4 years) |

| Market Linked GICs (not annual) | 15% up to 55% (term period – 5 years) |

| ScotiaBank Prime Rate | 7.2% |

| Website | scotiabank.com |

What are the GIC Rates of ScotiaBank?

Investors should always choose the correct type of GICs while making their investments. The correct type of GIC can will depend on financial situation, time period, goals, and other relevant factors. This is why most banks offer different kinds of GICs so that they can offer a wide range of choices to their customers.

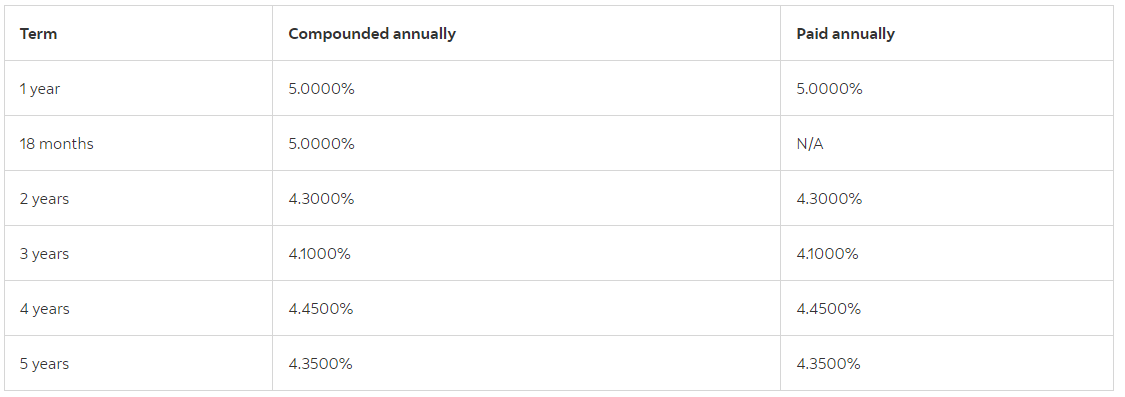

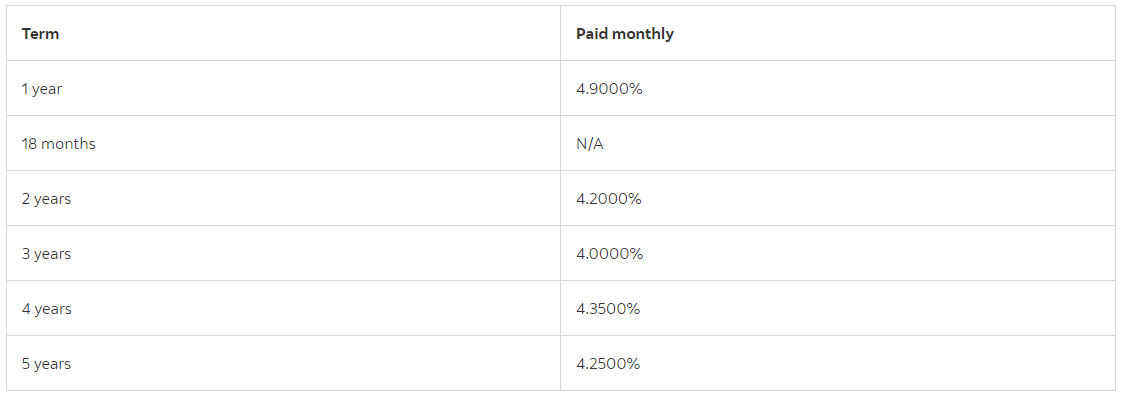

Long-term Non-Redeemable GIC rates

When someone purchases Non-Redeemable GICs, they invest a certain amount of their funds for a specific term to benefit from a fixed interest rate. When the term finishes, they have an option to either cash out their funds or renew them to keep growing.

| Term | Preferred package customer | Ultimate Package customer | Without Preferred/Ultimate Package |

| 3 Years | 5.02% | 5.12% | 4.10% |

The GIC Rates for the ultimate package, preferred package, and without Preferred/Ultimate Package are different from one another.

- Annual

- Semi-Annual

- Monthly

Short-term Non-Redeemable GIC Rates

| Term | Interest Rate (Annual) |

| 30 – 59 days | 2.15% |

| 60 – 89 days | 2.40% |

| 90 – 119 days | 2.75% |

| 120 – 149 days | 2.75% |

| 150 – 179 days | 2.75% |

| 180 – 269 days | 3.25% |

| 270 – 364 days | 3.55% |

Personal Redeemable GIC Rates

This type of GIC allows the customers to earn at a guaranteed rate and provides access to their investments partially or fully at a predetermined rate. This type of GIC features – Principal protection, Flexibility, and Return Guaranteed.

The annual rate of Personal Redeemable GIC is 4.50% on a 24-month term.

Cashable GIC Rates

| Type | Term | Interest Rate |

| Regular Cashable | 1 Year | 2.85% |

Aside from these types, the ScotiaBank also offers Guaranteed Income Optimizer, Index Powered GICs, Equity Powered GICs, and Market Linked GICs. Each one offers different benefits and interest rates. For more information on the current GIC Rates of ScotiaBank, investors can either contact the bank officials or they can visit the official website.

Please note that the current ScotiaBank GIC rates are effective from October 18, 2024. As we know, the rates frequently change with time and situations. Hence, investors should regularly check the updated GIC Rates before making their decisions.

|

Important Links |

What are the Prime rate and Mortgage Rates of ScotiaBank?

The prime rate offered by ScotiaBank is 7.2%. This rate is effective from July 13 onwards. The prime rate is used by banks to set their interest rates for various types of loans and credits. More information on ScotiaBank Prime rate is available on its website.

This means that the prime rate has the potential to influence other rates. The prime rate of ScotiaBank can affect variable mortgage rates. Hence, if ScotiaBank changes its prime rate, the mortgage rate will also be changed accordingly.

The mortgage rates of ScotiaBank are –

Variable Rate Mortgages

The interest rate in this type of mortgage is periodically adjusted depending on the index. People opt for the Variable Rate Mortgage when the rates are likely to go down in the future.

| Term | Type | Rate |

| 3 Year Closed Term | Scotia Ultimate Variable Rate Mortgage | 8.6% |

| Closed 5 Year Term | Scotia Flex Value Mortgage | 7.65% |

| Open 5 Year Term | Scotia Flex Value Mortgage | 10.4% |

Closed Term Fixed Rate Mortgages

This type of mortgage has a fixed interest rate over a specific time period. This option can be chosen if the interest rates are currently lower.

| Term | Rate |

| 1 year | 8.04% |

| 2 years | 7.64% |

| 3 years | 7.24% |

| 4 years | 7.04% |

| 5 years | 7.04% |

| 7 years | 7.2% |

| 10 years | 7.69% |

Short Term Fixed Rate Mortgages

Short term mortgages have significantly lower term periods but might have a bit higher interest rates.

| Type | Term | Rate |

| Open Mortgage | 6 months | 9.75% |

| Open Mortgage | 1 year | 9.75% |

| Flexible/Closed Mortgage | 6 months | 7.95% |

Please note that these rates can undergo changes in the future depending on various aspects. Therefore, borrowers should remain updated with all the latest aspects of mortgage loans and their interest rates.