Check out the information on NHS Dental Charges 2024/25: How Much Are NHS Dental Charges and How to Claim Them Back? from this article. Different information about NHS Dental Charges 2024/25: How Much Are NHS Dental Charges and How to Claim Them Back? and other relevant information are included in this article.

NHS Dental Charges 2024/25

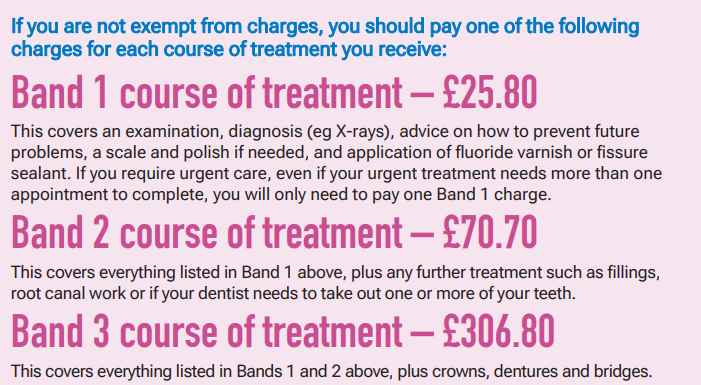

The National Health Service (NHS) offers various health services for the eligible citizens. One of these services includes Dentistry. The charges for the NHS Dental Treatment can vary depending on the type of course band.

There are 3 main course band that covers various dental services. The cost of the band 1 course is £25.80, the band 2 course is £70.70, and the band 3 course is £306.80. Any treatment that is clinically necessary to maintain or achieve good oral health is available on NHS.

|

Important Links |

Dental Charges Overview

| Name | NHS Dental Charges |

| Offered by | National Health Services |

| Country | UK |

| Band 1 Course | £25.80 |

| Band 2 Course | £70.70 |

| Band 3 Course | £306.80 |

| Applicable from | April 24, 2023, onwards |

| For more information | www.nhs.uk |

How Much Are NHS Dental Charges?

The NHS Dental Charges are based on the type of course of treatment band. Individuals are only required to pay once for each course of treatment, even if they visit the dentist more than once.

Most dentists provide both private as well as NHS treatment. Therefore, people should make sure what type of treatment they will be receiving before starting the course of treatment.

Some treatments are free of charge, such as the removal of stitches, repairing of dentures, and stopping bleeding from the mouth. In case the dentures are irreparable and the individual decides to get new ones, they have to pay a fee to get them.

Also, some people might qualify for an exemption from NHS Dental Charges. People can use the online tool provided by NHS to check if they qualify for the exemption.

NHS doesn’t offer cosmetic treatments that are not clinically necessary. For example, teeth whitening treatment is done to make teeth look more attractive.

If a person has been referred to a specialist NHS dental work by their current dentist, they only have to pay one charge if it is part of the existing treatment course.

However, if a person gets referred to another dentist, it is usually considered a separate course of treatment. This means that people might have to pay another dental charge, depending on what type of treatment they require.

List of Dental Treatments

There are 3 bands, with each having a different dental treatment and cost. Check the dental treatments by band-

Band 1 (£25.80)

- colour photographs

- treatment of sensitive cementum

- polishing, scaling and marginal correction of fillings

- study casts

- orthodontic case assessment and report

- instruction in the prevention of dental and oral disease

More specific information on other treatments in the Band 1 course can be obtained from the NHS Website. For each treatment, the dentists are required to tell about all available treatment options appropriate for the patients.

Band 2 (£70.70)

- free gingival grafts

- sealant restorations

- frenotomy, frenuloplasty, frenectomy

- bite-raising appliances

- soft tissue surgery (buccal cavity and lips)

- extraction of teeth

- root canal treatment

- gum disease treatment

- transplantation of teeth

- relining and rebasing dentures, including soft linings

Other dental treatments are also covered under the Band 2 course, such as the addition of tooth to dentures, oral surgery, etc.

Band 3 (£306.80)

Band 3 is costlier than the other 2 bands. Not only does it cover everything from Band 1 and Band 2, but it also covers crowns, laboratory work, bridges, and dentures. The complete list of Band 3 treatments can be obtained from the NHS website.

How to Claim Them Back?

Only the dental charges for the NHS treatment can be claimed back. This means that private dental treatments cannot be claimed by the individuals. In case a treatment includes both NHS and private treatment, only the refund of the NHS part can be claimed back.

|

Important Links |

The refund can be claimed by using the HC5 refund claim form. On this form, individuals have to explain why they wish to claim the refund. Moreover, people also need the dental receipt that shows the total charges paid with a date. Also, people can ask the dentist to provide an NHS receipt form FP64 for this purpose.

The HC5 form contains the address where people need to mail their form along with the receipt. Please note that the refund form will only be accepted if the form is sent within 3 months of the payment date of treatment. Check the authorized website of NHS to learn more about the refund process.