Find the potential details of the Maximum SSS Pension 2024: How Much is Maximum SSS Pension and How to Compute it? The discussion for the Maximum SSS Pension is according to the 13% contribution that the citizens have made when they were employed. The older citizens who are retiring this year will receive the max amount. Find out the more relevant information further form this article.

Maximum SSS Pension 2024

The eligible citizens to make the relevant SSS Contributions to receive the Maximum SSS Pension 2024. The amount will be ₱18,495 for those individuals who are registered in the Government’s database.

The pension will be provided according to contributions that are PHP 1,120 to PHP 4,200 per month. These are from the employee and the employer for the working years.

|

Important Links |

How Much is Maximum SSS Pension?

The citizens who are more than 60 years old are eligible to get the pension. They have to be the taxpayers and the contributors to get the feasible amount.

13% is the current contribution rate according to which the citizens will receive the pension. The increase will take place for around 1% until 2025. The pension depends on the family that you have and the total years in which you were active to make the necessary SSS Contributions.

How to Plan a Retirement in the Philippines?

Most of the Filipinos seek benefits after the retirement when they plan it in a better way. We have shared the details of the early planning for retirement.

- Investment Funds: If the retiree has lump sum savings then they can make investments in the stock, mutual funds, or similar to earn a passive income after the retirement. They can gain knowledge of the financial market to make the relevant investments.

- SSS Pension Plan: As we have mentioned, there are contributions that need to be made by the citizens to get a pension at the age of retirement.

- Apply for the VUL Insurance: This is a plan that allows the retirement fund to grow according to the insurance that you have applied for.

It does not matter whether the citizen is a government employee or a private one. They can still follow the above mentioned pensionable schemes.

How to Compute it?

There is an online SSS Calculator in which people have to enter their salary, contribution rate, total contributions, and more. Now, tap on ‘Compute’. The data will show the approximate values of the pension that you can collect from the officials.

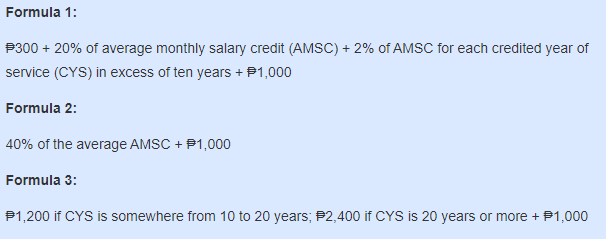

The image above represents the formulas that the officials could use to compute the pension. The salary has to be computed by entering the accuracy. If you are still in a confusion, then visit the nearest SSS Office.

Philippines Minimum Wage Increase 2024

The great news that can be heard from the civil servants of the country is that they will be getting an increased amount this year. The Government has considered the 6.5% increase in goods, 6.8% in Technology and 6.7% in Retail & wholesale workers. The Philippines Worker Salary Increase will be a profitable deal for senior citizens. They can cope with the financial challenges of every month. The people who have to handle the family members or their loans on the head can utilise the payment for their sake.

|

Important Links |

Ways to Claim Pension in the Philippines

It is the time for the citizens to collect a significant amount for managing their households and to lead a standard life. The Filipinos who are willing to receive the pension from 2024 then they can follow an easy procedure.

Step 1 The RCA Form has to be filled correctly. The form can be found on the relevant portal.

Step 2 A valid ID, Passport-sized photos, sign, and other details have to be mentioned.

Step 3 Next up are the relevant documents that need to be submitted in the particular format. A copy of the salary slip, residency proof, birth certificate, ID, evidence of the property if you have one, and more.

Step 4 The documents and the details of the SSS Pension officials will be attached to the form.

Step 5 Lastly, the Letter of Authority has to be submitted with the sign of the Special Power of Attorney.

The online process is quite convenient. If you do not feel perfect with this one, then you can visit the nearest SSS office to claim the amount.