Check out the details on $1900/Year CPP Increase Possible: Canada is Planning for CPP Boost? Is it true? All We Know So Far from this article. Different information on $1900/Year CPP Increase Possible: Canada is Planning for CPP Boost? Is it true? All We Know So Far and other significant details are included in this article.

$1900/Year CPP Increase Possible

Canada Pension Plan provides retirement pension and disability benefits for many Canadians. These benefits are usually based on the contributions to the CPP that a person has made throughout their lifetime.

The maximum benefit offered as CPP Retirement can be up to 1,306.57 per month pension. In addition, people can also get 40.25 dollars as a post-retirement benefit if they keep working. The maximum monthly amount of the CPP retirement pension is not likely to increase by a substantial amount of $1900/year in 2024.

|

Important Links |

Is Canada Planning for CPP Boost?

CPP is being boosted gradually by the enhancement. The second component of the CPP will be introduced in 2024, which is likely to increase the monthly benefits of the CPP that the workers of now will receive when they retire.

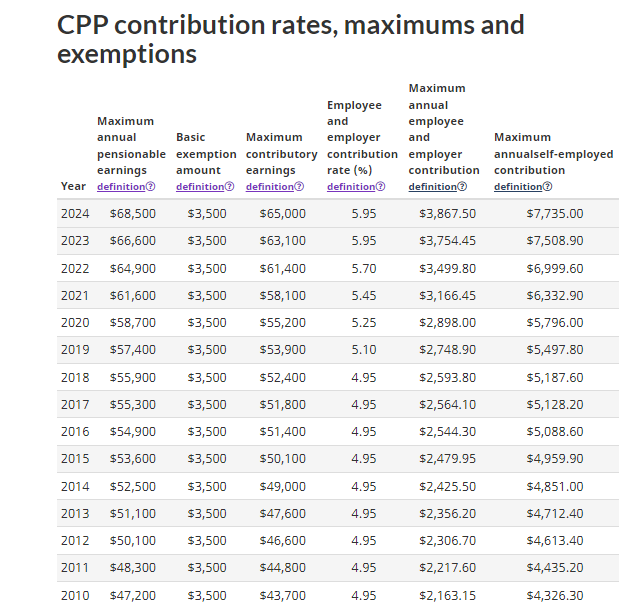

Furthermore, the amount of maximum contributions of both employees and employers also increases each year, depending on the economic situation. The maximum pensionable earnings for 2023 was 66,600 dollars. However, the Canada Revenue Agency made some changes in the CPP and adjusted this amount to 68,500 dollars in 2024.

This means that the employers and employees will be able to contribute more to the CPP, which will ultimately increase the CPP benefits that the individual will receive in the future.

Moreover, if the CRA keeps on increasing the contribution limit and the rate of employee and employer contribution each year, the benefits offered by the CPP will be quite substantial. With the increased benefits, people will also be able to keep up with the cost of living increases in the future, plan for their retirement, etc.

People who are making retirement plans should consider whether they can receive the CPP benefits. If they are qualified to receive the benefits, they should regularly check their contributions and plan them in such a way that they can receive the maximum possible benefits after retirement.

CPP Contribution Rates

The contribution rates for the CPP are usually changed each year. The changes include the maximum pensionable earnings, CPP contribution rates, maximum contributory earnings, etc. The maximum annual contribution by the employees and the self-employed people are different from one another.

In 2022, the Annual maximum pensionable earnings was 64,900 dollars. In 2023, the limit was increased to 66,600 dollars, and now it has been decided that this limit will be increased to 68,500 dollars in 2024.

In 2022, the maximum contributory earnings was set at a limit of 61,400 dollars. In 2023, the limit was changed to 63,100 dollars, and now the maximum contributory earnings have been increased to 65,000 dollars in 2024.

Although most of the rates and maximums have been changed for 2024, exemptions have remained unchanged. The basic exemption amount is 3500 dollars. This amount has not changed since 1996. In 1995, the basic exemption amount was 3400.

The contribution made by the employers and employees will be made at a rate of 5.95% (each). This contribution rate will remain the same as the rate in 2023. Similarly, the contribution rate for self-employed people is also the same as in 2023, i.e., 11.9%.

This means that the employees and employers can contribute a maximum amount of 3,867.50 in 2024, and the self-employed people will be able to contribute a maximum amount of 7,735 dollars in 2024.

To learn about all the changes associated with the CPP, such as maximum limits, exemption amount, new and upcoming contribution rates, and other relevant things can be obtained from the Canadian Government’s website.

|

Important Links |

All We Know So Far About CPP Increase

The CPP increase can result in a large monthly retirement pension amount when people take their retirement. The maximum amount is paid ton the citizens who take their retirement at the age of 70, who also have the required number of valid CPP contributions.

As the second component of the CPP is now available, people will now be able to contribute to it and gain increased benefits later. The amount that people can contribute to the CPP’s additional second component is also provided by the CRA. This rate is set at 4% for 2024 and 2025. The additional maximum pensionable earnings for 2024 will be 73,200 dollars and 79,400 dollars in the following year, i.e., 2025.