Check out the details about Canada Tax Rebate Dates: Types of Tax Rebates in Canada and Who Qualifies? from this article. Various details about Canada Tax Rebate Dates: Types of Tax Rebates in Canada and Who Qualifies? and other notable details are included in this article.

Canada Tax Rebate Dates

The Tax Rebates are generally claimed by submitting the claim applications. The tax rebate in Canada allows citizens to get rebates on taxes paid on goods and services. This can also include amounts paid in error, investment plans, etc.

|

Important Links |

The most commonly seen tax rebate in Canada is the GST/HST Rebate. In the case of Quebec, the citizens can claim refunds on the paid QST on goods and services. The rebates are paid after the CRA accesses the claim application submitted by the eligible taxpayers of Canada.

Types of Tax Rebates in Canada

The tax rebates in Canada may include GST/HST Rebates, QST Rebates, Grocery Rebates, etc. Although there are also some other types of rebates, including EV Rebates, Carbon Tax Rebates, etc., they are applicable in certain regions and for specific things.

The tax refunds usually depend on the time of filing and the method of filing. The CRA, which administers tax-related services, sends the refunds within 2 weeks (online filing) or 8 weeks (paper filing). In case someone lives outside of Canada, the refunds can take up to 16 weeks to be issued (for non-residential personal tax returns).

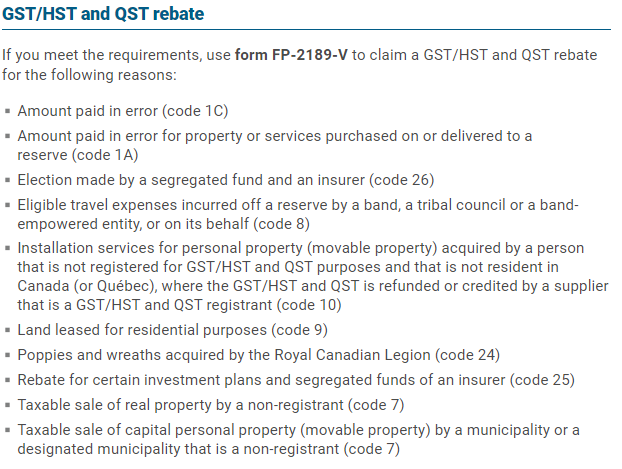

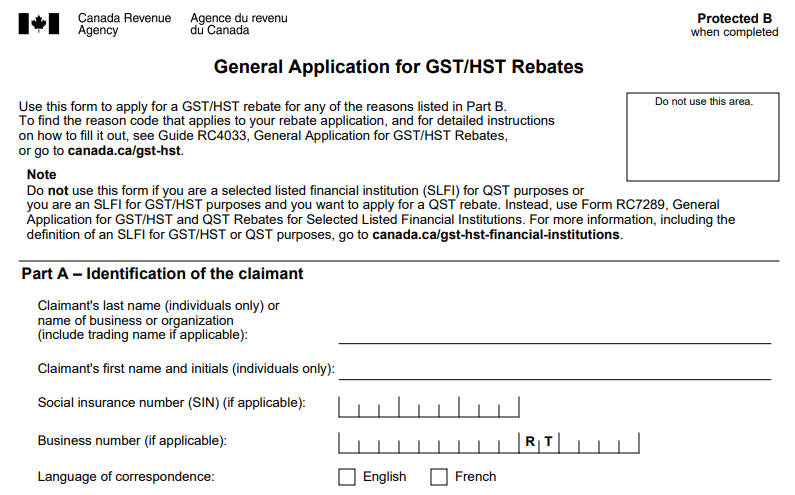

For GST/HST and QST Rebates, the Citizens can claim the rebate only if they meet the requirements and conditions set by the authorities. There are a number of reasons for which citizens can file their tax rebates, with each season having different application forms.

The complete list of reasons, along with their reason codes and eligibility requirements, can be obtained by visiting the authorized website of the CRA. Some of the basic reasons for filing the application for the GST/HST and QST Rebates in Canada might include –

Amount paid in error

- This can be submitted by using the general application for GST/HST Rebate (GST189).

- The code for this type of reason is Code 1C.

- This is usually applicable when someone pays the GST/HST that they shouldn’t have paid or overpaid.

- The citizens get 2 years to file their applications from the day they paid in error.

- In addition, they can only send 1 application per month.

Election made by a segregated fund and an insurer

- This can be claimed by using the general application for GST/HST Rebate.

- The code for this type of reason is Code 26.

- This allows an insurer’s segregated fund to get rebates for services provided by the insurer.

- The segregated fund can send 1 application per calendar month.

- Applicants should not include any types of documents with the general application. However, they should keep them if CRA asks to check them in the future.

Taxable sale of real property by a non-registrant

- This can also be claimed using the general application for GST/HST Rebate.

- The code for this type of reason is Reason Code 7.

- If an individual who is not registered has sold a taxable property, paid GST/HST on the acquisition, and was unable to recover the tax previously paid, they can apply for the rebate.

- More information on the eligibility and required documents for this reason can be obtained from the CRA’s website.

Land leased for residential purposes

- Use the general application for GST/HST Rebate to apply for this reason.

- The code for this type of reason is Reason Code 9.

- This applies when someone who owns or leases land pays GST/HST and must self-assess and remit tax on a value that includes the land.

- Individuals get 2 years to file their applications.

Aside from these, there can be many reasons for which the citizens can claim the GST/HST and QST rebates. Please note that the Grocery Rebate is issued with the GST/HST Credit, not with the rebate.

|

Important Links |

Who Qualifies for Tax Rebates in Canada?

The taxpayers who satisfy the available reasons, such as amounts paid in error, Land leased for residential purposes, Legal aid plan, etc., are eligible to get the GST/HST tax rebates in Canada. The tax rebates can be filled by submitting the appropriate claim forms with the required documents.

After accessing the applications, the CRA notifies whether or not someone will receive the rebate. In addition, the CRA also notifies about the changes made by them in the rebate amount (if any). Please check the official website of CRA to learn more about the required qualifications for a tax rebate and tax rebate dates in Canada.